2020年6月29日晚,《关于海南离岛旅客免税购物政策的公告》发布。为了让全球的投资者第一时间了解海南自贸港免税购物政策,海南国际经济发展局立即联系了全球免税业权威研究机构《Moodie Davitt Report》,为其提供相关政策英文翻译材料,推动利用《Moodie Davitt Report》全球平台向投资者推介海南自贸港免税产业投资机遇。以下是《Moodie Davitt Report》的官方报道:

Hainan update: New offshore duty free rules a travel retail game changer

海南最新消息:全新离岸免税规定-旅游零售行业的主导者

Further key details have emerged of the changes to China’s offshore duty free shopping policy to be introduced in Hainan province on 1 July, including a tremendous boost to the travel retail wines & spirits sector.

中国将在7月1日宣布即将在海南实施的离岸免税购物政策的更多的关键细节,其中包括对旅游零售葡萄酒&烈酒行业的巨大推动。

As revealed by The Moodie Davitt Report, the Chinese Ministry of Finance, the General Administration of Customs and the State Administration of Taxation today announced a widespread stimulation package to assist the hugely successful offshore shopping policy introduced in 2011.

正如Moodie Davitt Report所提到的,中国财政部、海关总署和国家税务总局今天宣布了一项的涵盖内容广泛的免税促进方案,以帮助之前在2011年推出的已经非常成功的离岸购物政策。

The Chinese central government released the Master Plan for the construction of Hainan Free Trade Port in early June. As reported, this stipulated that the offshore duty free shopping limit would be more than tripled to RMB100,000 (US$14,050) per person per year.

中国政府于6月初发布了《海南自由贸易港建设总体方案》。据报道,这项方案将离岸免税购物限额提高至三倍以上,达到每人每年10万元人民币(合14050美元)。

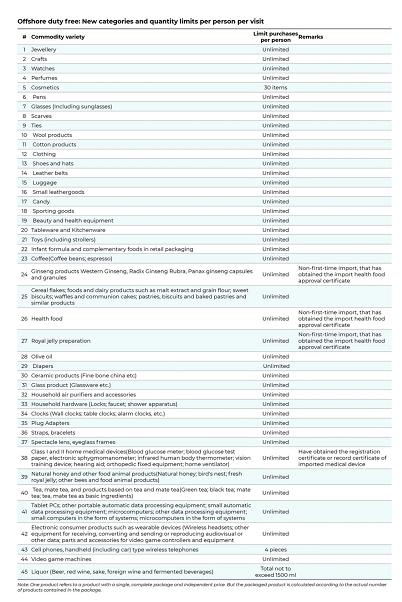

Today’s announcement affirms that decision and extends the offshore duty free benefits considerably. For example, among the new permitted categories is liquor (subject to a 1.5 litre allowance restriction per visit, as long as the RMB 100,000 allowance for total purchases by an individual customer is not exceeded in a year, a Hainan Provincial Bureau of International Economic Development confirmed to The Moodie Davitt Report), as well as watches, phones (four pieces per person a year), computers and fashion. The liquor category includes beer, sake, imported wines and spirits.

今天发出的公告肯定了这一决定,并极大地扩大了离岸免税好处。例如,在新的授权品类中,有酒类商品、手表、手机(每人每年4件)、电脑和时尚用品。酒类包括啤酒、清酒、进口葡萄酒及发酵饮料。

Compared with previous policies, the latest announcement’s main adjustments are as follows:

与之前的政策相比较,最新的政策主要调整如下:

The offshore shopping quota has been increased from RMB30,000 (US$4,215) to RMB100,000 (US$14,050)

免税购物额度从每年每人3万元提高至10万元。

The number of categories is increased from 38 to 45.

离岛免税商品品种由38种增至45种。

The limit of RMB8,000 (US$1,129) for a single tax-free purchase is removed. With quota management adopted as the main form of administration, the types of goods that are limited by the quantity of a single purchase are substantially reduced.

取消单件商品8000元(1,129美元)限额规定。以额度管理为主,大幅减少单次购买数量限制的商品种类。

Proper competition is encouraged” and all business entities with a tax-free product distribution qualification [i.e. licence] can equally participate in the offshore tax and duty free business on Hainan Island.

鼓励适度竞争,具有免税品经销资格的经营主体均可平等参与海南离岛免税经营

Intensified supervision will be conducted during and after business activities. Legal responsibilities of individuals, enterprises and offshore tax free shops who participate in reselling and smuggling will be defined clearly.

加强事中事后监管,明确参与倒卖、走私的个人、企业、离岛免税店将承担的法律责任。

[Note: Individuals who resell, purchase for others or smuggle duty free commodities are regarded as violating the provisions of this announcement. Such violations shall be recorded in their credit records in accordance with laws and regulations, and they shall be prevented from making any offshore duty free purchases for three years.Those engaged in smuggling or violating customs supervision regulations shall be held accountable by the customs authority in accordance with relevant provisions. If a crime is constituted, criminal responsibility shall be investigated according to law.]

[注:个人倒卖、为他人购买或者走私免税商品的,将视为违反本规定。对违反规定的,应当依法记入信用记录,三年内不得进行离岸免税采购。走私或者违反海关监管规定的,由海关按照有关规定追究责任。构成犯罪的,依法追究刑事责任。]

See full translation of the new regulations below, courtesy of Hainan Provincial Bureau of International Economic Development.

新规定全文如下,由海南国际经济发展局提供。

Key details of the revised offshore duty free shopping policy

修订后的离岸免税购物政策的主要细节

1. The offshore tax-free policy refers to preferential tax policies for passengers who depart the island (excluding departing national borders) by plane, train or ship.

They can purchase within a limited value, limited quantity and limited varieties; pay at offshore duty free shops or approved online sales platforms; and collect the goods from designated areas of airports, railway stations and ports. The tax items under the offshore tax free policy include tariff, import value-added tax and consumption tax.

一、离岛免税政策是指对乘飞机、火车、轮船离岛(不包括离境)旅客实行限值、限量、限品种免进口税购物,在实施离岛免税政策的免税商店(以下称离岛免税店)内或经批准的网上销售窗口付款,在机场、火车站、港口码头指定区域提货离岛的税收优惠政策。离岛免税政策免税税种为关税、进口环节增值税和消费税。

2. The term passenger refers to domestic and foreign passengers (residents of Hainan included) who have reached the age of 16 and have purchased air tickets, train tickets or ship tickets to depart from Hainan and hold valid identity documents (resident identity cards for domestic passengers, travel documents by Hong Kong, Macao and Taiwan passengers, passports for foreign passengers), and leave Hainan Island but do not leave the country.

二、本公告所称旅客,是指年满16周岁,已购买离岛机票、火车票、船票,并持有效身份证件(国内旅客持居民身份证、港澳台旅客持旅行证件、国外旅客持护照),离开海南本岛但不离境的国内外旅客,包括海南省居民。

3. The amount of offshore tax-free shopping per person per year is RMB100,000, with no limits on the times of purchase. The types of tax free commodities and limit on the quantity of a single purchase are mentioned in the annex to this announcement.

For any value and quantity that exceeds the limits, import duties shall be levied in accordance with relevant regulations. Tax free purchase made by passengers who leave the island by plane, train or ship is recorded as one duty free shopping visit.

三、离岛旅客每年每人免税购物额度为10万元人民币,不限次数。免税商品种类及每次购买数量限制,按照本公告附件执行。超出免税限额、限量的部分,照章征收进境物品进口税。

旅客购物后乘飞机、火车、轮船离岛记为1次免税购物。

4. The offshore tax-free shops mentioned in this announcement refer to shops with the offshore tax-free selling qualification [licence] and operational franchise. Currently, they include:Haikou Meilan Airport duty free, Haikou Riyue Plaza, Qionghai Boao, and Sanya Haitangwan [CDF Mall].

Any business entity with the distribution qualification [i.e. licence] for duty free products can participate in duty free operations on Hainan Island in accordance with regulations.

四、本公告所称离岛免税店,是指具有实施离岛免税政策资格并实行特许经营的免税商店,目前包括:海口美兰机场免税店、海口日月广场免税店、琼海博鳌免税店、三亚海棠湾免税店。

具有免税品经销资格的经营主体可按规定参与海南离岛免税经营。

5. Within the limits and quantities specified by the state, passengers departing the island can purchase tax free goods at a duty free shop or an approved online sales platforms. Duty free shops shall deliver the goods according to passengers’ respective departure times. Passengers shall collect the goods in the designated areas of airports, railway stations and ports, together with their shopping vouchers, and take all goods with them to leave the island.

五、离岛旅客在国家规定的额度和数量范围内,在离岛免税店内或经批准的网上销售窗口购买免税商品,免税店根据旅客离岛时间运送货物,旅客凭购物凭证在机场、火车站、港口码头指定区域提货,并一次性随身携带离岛。

6. The tax free commodities purchased by passengers are regarded as final products for personal use by consumers and cannot be sold again in the domestic market.

六、已经购买的离岛免税商品属于消费者个人使用的最终商品,不得进入国内市场再次销售。

7. Individuals who resell, purchase for others or smuggle duty free commodities are regarded as violating the provisions of this announcement. Such actions shall be recorded in their credit records in accordance with laws and regulations, and they shall be prevented from making any off shore duty free purchase within a period of three years.Those engaged in smuggling or violating customs supervision regulations shall be held accountable by the customs authority in accordance with relevant provisions. If a crime is constituted, criminal responsibility shall be investigated according to law.

Travel agencies and transportation enterprises that assist in violating the offshore tax free policy and disrupt the market shall be subject to rectification according to sectoral administration.

Offshore duty free shops that violate relevant regulations shall be punished and held accountable by the customs authority in accordance with relevant laws and administrative regulations.

七、对违反本公告规定倒卖、代购、走私免税商品的个人,依法依规纳入信用记录,三年内不得购买离岛免税商品;对于构成走私行为或者违反海关监管规定行为的,由海关依照有关规定予以处理,构成犯罪的,依法追究刑事责任。

对协助违反离岛免税政策、扰乱市场秩序的旅行社、运输企业等,给予行业性综合整治。

离岛免税店违反相关规定销售免税品,由海关依照有关法律、行政法规给予处理、处罚。

8. The measures for the supervision of the offshore tax-free policy shall be separately promulgated by the General Administration of Customs.

The relevant VAT and consumption tax exemption policies applicable to the tax free goods sold in the offshore tax free shops shall be separately formulated by the Ministry of Taxation and the Ministry of Finance.

八、离岛免税政策监管办法由海关总署另行公布。

离岛免税店销售的免税商品适用的增值税、消费税免税政策,相关管理办法由税务总局商财政部另行制定。

9. This announcement will be implemented from July 1, 2020. Ministry of Finance Announcement No. 14 in 2011, No. 73 in 2012, No. 8 in 2015, No. 15 in 2016, No. 7 in 2017, and No. 158 of the Ministry of Finance, General Administration of Customs and General Administration of Taxation in 2018, No. 175 in 2018 shall be abolished at the same time.

九、本公告自2020年7月1日起执行。财政部公告2011年第14号、2012年第73号、2015年第8号、2016年第15号、2017年第7号,及财政部、海关总署、税务总局2018年公告第158号、2018年第175号同时废止。